Toohighmyguy

- 225

- 63

Just wanted to get some feedback on a peculiar accounting practice. On my States medical marijuana taxes. Or better yet its math program. If it has one. I get up this morning, as routine,

Pow hot cup of java. Whoop whoop. So what's the next step of the morning. You know it!!!!

Pow hot cup of java. Whoop whoop. So what's the next step of the morning. You know it!!!!

This is wear it interesting. So understand, my state has a monopoly these lovely ladies. Meaning not recreational or personal growing. But, something for some very odd reason. Just hit me like,"I'm a dumbass, but today I'm going to prove myself wrong". So the first thing I see after my java and joint was this

This is wear it interesting. So understand, my state has a monopoly these lovely ladies. Meaning not recreational or personal growing. But, something for some very odd reason. Just hit me like,"I'm a dumbass, but today I'm going to prove myself wrong". So the first thing I see after my java and joint was this

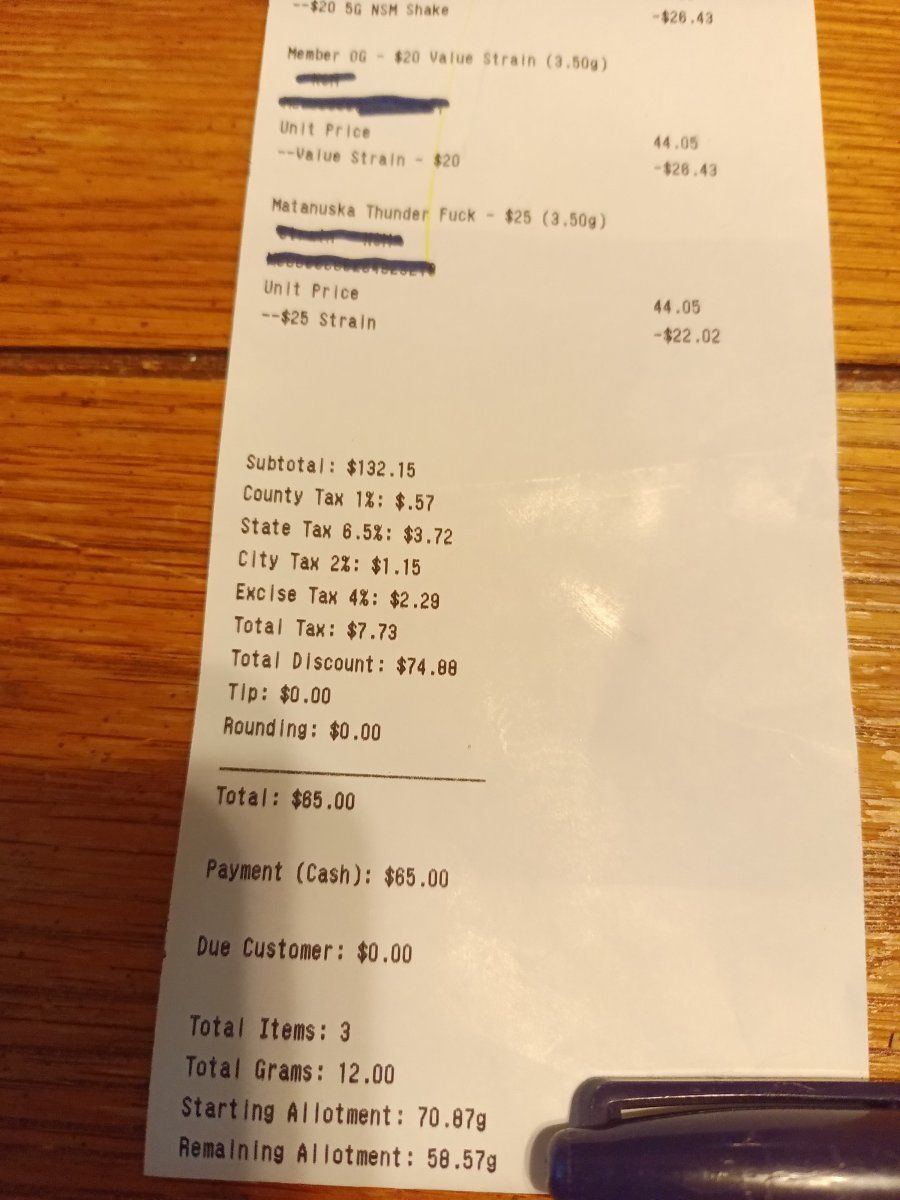

Just for reference I get side tracked on details sometimes. I'm not very smart, so I broke out Mr. Math

Just for reference I get side tracked on details sometimes. I'm not very smart, so I broke out Mr. Math

A fifty year old mans personal mathematician. So everything starts coming together.

A fifty year old mans personal mathematician. So everything starts coming together.

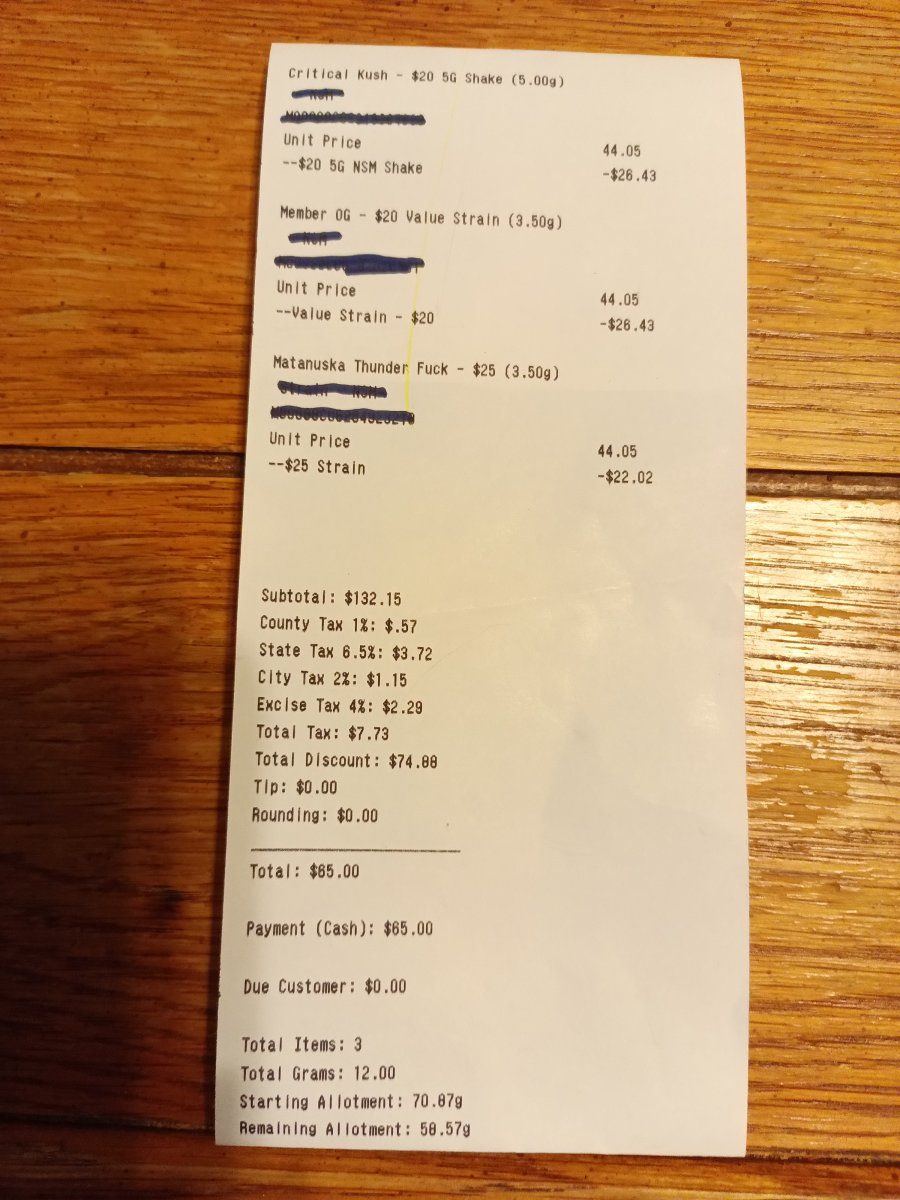

This is some tax and mathematical manipulated output. The Medical Marijuana dispensary. The receipt shows 3 items I purchased. I guess these items were considered on sale. So they also list the original price and showed what you supposed to save. And walla your taxed at the full amount. Even though your purchase was only approximately 50% of original price. Am I wrong or does that not double my taxes from 13.5% to 27%. I know I can ramble on. So Bear with me. This part really messed me up.

This is some tax and mathematical manipulated output. The Medical Marijuana dispensary. The receipt shows 3 items I purchased. I guess these items were considered on sale. So they also list the original price and showed what you supposed to save. And walla your taxed at the full amount. Even though your purchase was only approximately 50% of original price. Am I wrong or does that not double my taxes from 13.5% to 27%. I know I can ramble on. So Bear with me. This part really messed me up.

How did I lose 0.3 of a gram in a 12 gram purchase. All answers are good awnsers. Time to roll another one. Am I on to something?

How did I lose 0.3 of a gram in a 12 gram purchase. All answers are good awnsers. Time to roll another one. Am I on to something?